Over the past several years, there has been increasing concern over the threat of international money laundering operations that allow criminals to move billions of dollars illegally overseas and out of the reach of their victims. Gilbert Chikli is one of the most notorious financial con men to date, godfather of the ‘Fake CEO’ scam that allowed him to steal more than 8 million Euros from many of the largest corporations in the world. Despite being convicted of fraud among other things, and sentenced to seven years in a French prison, Chikli is still living freely in Israel today.

The Money Laundering Scam

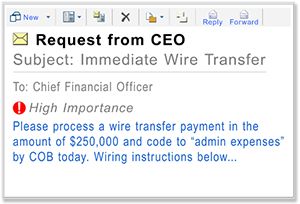

Gilbert Chikli started off by employing a bold scam over the phone, never expecting his scam to actually work on a grand scale. One day he picked up the phone and placed a seemingly urgent phone call to a local bank acting as the CEO. He insisted that in the wake of recent terrorist attacks in the region, he was investigating whether or not some of the accounts at the bank could be linked to terrorist organizations. He asked the bank’s manager to bring him nearly 400,000 Euros cash at a local cafe where he would take it along with information regarding the largest accounts with the bank to determine if the money was clean or not, at which point he would return the cash to the bank. Needless to say, after receiving the cash, Chikli took off and was nowhere to be found.

While it may seem absurd that anyone would pack a duffel bag with 400,000 Euros and meet a stranger in a restroom to hand it over, the reality is that Chikli fed off of a sense of fear that was linked to the idea of local terrorists. He was able to convince his victims that they were playing a vital role in stopping the next major attack. Chikli placed dozens of phone calls over the next several years, managing to defraud 33 companies including HSBC, Disneyland Paris, and the French Post Office among others.

Moving the Money

Unfortunately for Chikli, most of the industrialized western world has put safeguards and sanctions in place to detect and prosecute money laundering operations. As a result, even after he had money transferred to his accounts, it was nearly impossible for him to spend it without tipping off government agencies. He needed a way to move money into and out of the country and convert it into “washed” funds. China provided just the right place. Currently, China has few laws regarding money laundering, and the laws they do have are not uniformly applied or enforced. There are numerous underground networks used to transfer money into and out of the country all with seemingly legal paper trails. One of these networks allowed Chikli to purchase assets in China and then export them to other countries with inflated receipts. For instance, he could purchase 10 tons of steel in China and export it to Europe along with a receipt that stated 100 tons of steel were purchased. For a small bribe, many Chinese businesses were willing to fabricate documents to corroborate his story. Once the money was associated with actual goods, it could be cleanly moved around the world and cashed out.

The Investigation

After receiving numerous calls reporting large scale theft with the “Fake CEO” scam, first France’s law enforcement agencies and then international agencies were investigated the case. They were able to trace tens of thousands of money laundering transfers into and out of Chikli’s accounts. He was arrested and spent three years in a French prison while waiting for an indictment. He was released in 2009 because prosecutors failed to gather enough evidence of his money laundering scheme to convict him. He promptly took his money and moved to Israel, where he remains. Finally, after two more years, France was able to convict Chikli in absentia to 7 years in prison, and fine him 1.1 million Euros for his crimes. However, Israel does not have an extradition treaty or agreement with France, and now Chikli lives freely on the coast in a large gated home, conducting interviews with news agencies candidly discussing his crime spree.

As a result of crimes like Chikli’s, several governments have come together to create the Financial Action Task Force, an inter-governmental body that promotes best practices in money laundering detection and provides resources to countries struggling with enforcement of anti-money laundering laws. China has joined the task force, requiring it to report any signs of suspected money laundering and to comply with international banking standards. China has been the world’s number one resource for money laundering operations. China is actively engaged in expanding their presence in global markets and will need to reform their reputation for illicit money transfers before western financial institutions will trust them.

Money Laundering Charges

Keep in mind, not everyone charged with money laundering is guilty. Money laundering charges tend to be vague and may lead to other related charges. And money laundering convictions can result in severe penalties. If you face allegations or charges of money laundering, contact the legal team at Robert G. Stahl, Esq. Criminal Defense Lawyers. The firm includes a former Assistant United States Attorney and prosecutor. who has extensive background in criminal investigations and trials. To contact us to discuss your case, call 908.301.9001 for our NJ office and212.755.3300 for our NYC office, email us at rstahl@stahlesq.com, or contact us online.

This blog is not legal advice. If you face allegations of money laundering, contact the legal team at Robert G. Stahl, Esq. Criminal Defense Lawyers. The firm includes former Federal and State prosecutors and seasoned criminal defense attorneys with years of experience handling criminal investigations and trials.

Leave A Comment