Goldman Sachs (NYSE: GE) recently agreed to a $5.6 billion dollar settlement for its role in bundling subprime mortgages for sale to investors without disclosing that the mortgages had an unusually high percentage of credit and compliance issues. In doing so, it joins a number of other high profile banks who have admitted wrongdoing with regard to their roles in the mortgage frenzy that led up to the financial crisis in 2008.

Goldman Sachs took advantage of the mortgage boom. When the mortgage industry was in full swing, Wall Street made sure to benefit as well. Originators were making so-called stated income and stated asset loans with little or no underwriting controls, and passing along the risk to successive lenders. Goldman Sachs, and others, bundled thousands of toxic subprime mortgages and sold them to investors.

Surprisingly, many prosecutors don’t see the banks as part of the machinery of fraud, and have targeted only the borrowers, appraisers, and mortgage brokers involved in fraudulent mortgages for criminal charges. Many of the banks engaging in this risk shifting behavior are considered “victims” in the multitude of mortgage fraud cases that arose during this period. The tide may be turning. In a noteworthy case in California, a straw buyer in a mortgage fraud case mounted a successful defense to charges of mortgage fraud, with the very simple question: how can the borrower have committed fraud if the lender didn’t care whether his answers on the mortgage application were truthful? The success of the defense relied, in part, on testimony from a former banking regulator that it was well known in the banking industry that so called “stated income” loans–also known as “liar’s loans”– were 90% fraudulent, and that making such loans meant banks had to gut their own underwriting controls. The jury found that the truth or falsity of the documentation provided by the borrower was immaterial because the lenders would have made the loans anyway.

The contributory conduct of “victim” originators and banks is also relevant in the context of pleas and sentencing for our clients accused of bank fraud, wire fraud, and money laundering. In cases where a trial is not possible, we aggressively challenge the “loss” calculation, which determines the possible Guidelines sentencing range. We have also argued that the knowing participation of the “victim” banks and lenders in the mortgage meltdown should be considered as a basis for a variance from the Sentencing Guidelines range, resulting in a lower sentence for our mortgage fraud clients.

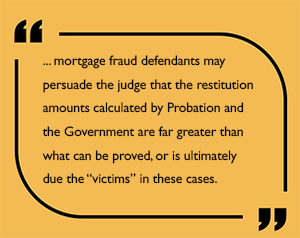

In these cases, the loss amount is determined by calculating the amount the successive lender paid the original lender for the loans (less any principal repayments by borrowers) and what it received for the property at the foreclosure sale. In simplest of terms, the formula for loss for restitution purposes is how much the successor lender paid, minus how much it made. Using this formula and demanding supporting documentation, mortgage fraud defendants may persuade the judge that the restitution amounts calculated by Probation and the Government are far greater than what can be proved, or is ultimately due the “victims” in these cases.

The lawyers at the Stahl Gasiorowski Criminal Defense Lawyers are dedicated to finding law and facts to defend our clients, whether at trial, across the table from a prosecutor during plea negotiations, or before a sentencing judge. We are constantly updating our knowledge and coming up with novel, creative and effective arguments to provide our clients the best defense.

Leave A Comment